Inheritance

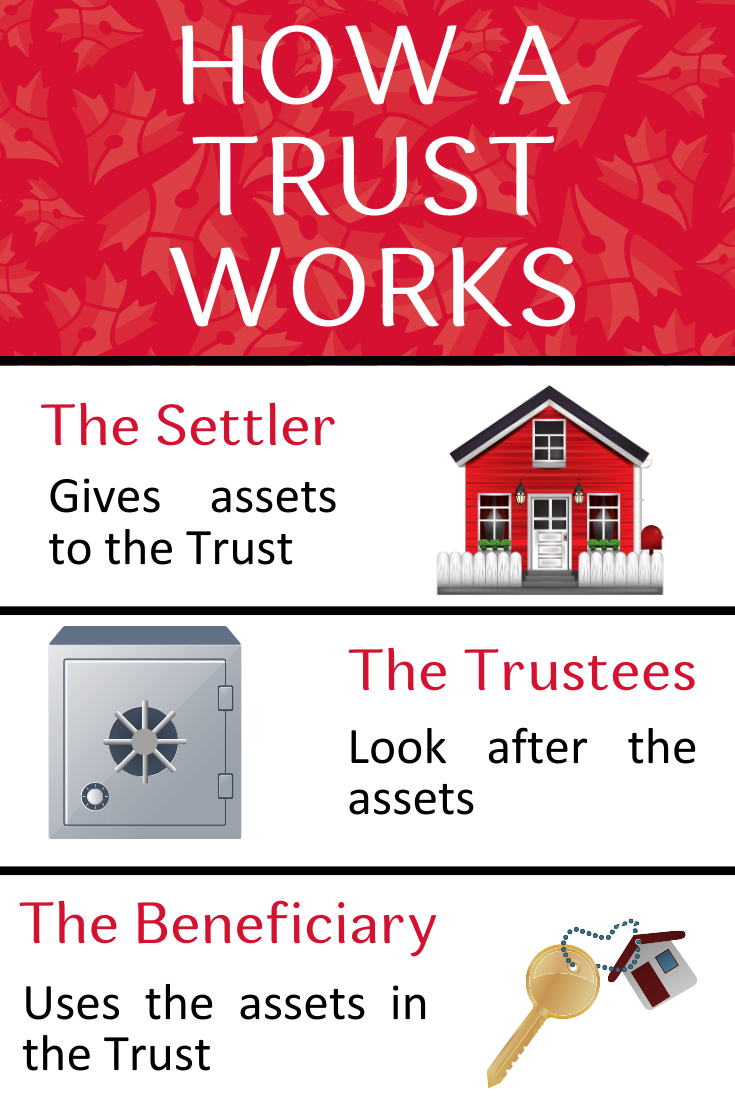

Trusts serve as powerful inheritance tools by providing enhanced control and asset protection. Unlike a direct bequest in a will, a trust allows you to dictate exactly when and how beneficiaries receive their inheritance, which is particularly beneficial for protecting young or vulnerable beneficiaries. Thrusts also offer protection from creditors, for example if a beneficiary is going through a bankruptcy or divorce. One key benefit is that assets in trust bypass the probate process, often making estate administration easier and faster.